Un-Just Transition: How fossil fuels and forced labor taint the solar energy sector in Xinjiang, China

Anita Dorett, Director, & Nicole Bohannon, Program Support Fellow, Investor Alliance for Human Rights

The investment community has flocked to invest in the renewable energy sector to support the global transition to clean energy as governments, civil society, and businesses around the world are working to meet sustainability goals and to combat climate change. Since 2004, clean energy investments globally have grown from under $37 billion to a peak of $331 billion in 2017, with the highest investment in wind and solar energy. Governments and businesses, including investors, need to ensure that there is a just transition to renewable energy that doesn’t come at the expense of people and the planet.

“From a human rights and climate perspective, the alternative of basing our green energy future on coal’s high carbon emissions and on the forced labour of oppressed communities is a higher and longer-term price to pay.”

China currently dominates the solar industry with Chinese companies controlling around 80% of the world’s solar supply chain, from raw material refinement to panel production and assembly. Delving deeper into China’s solar sector supply chain, we learn that in 2020, 45% of the world’s supply of polysilicon, the key refined material comprising 95% of solar panels, came from the Xinjiang Uyghur Autonomous Region in China (“Xinjiang” or “the Uyghur Region”). The US government and other governing bodies in the UK, Canada, and the Netherlands have declared that China has committed genocide and crimes against humanity in its treatment of Uyghurs and other Muslim-majority peoples in Xinjiang, tarnishing investments in solar companies whose supply chains emanate from Xinjiang.

In Broad Daylight: Uyghur Forced Labour and Global Solar Supply Chains

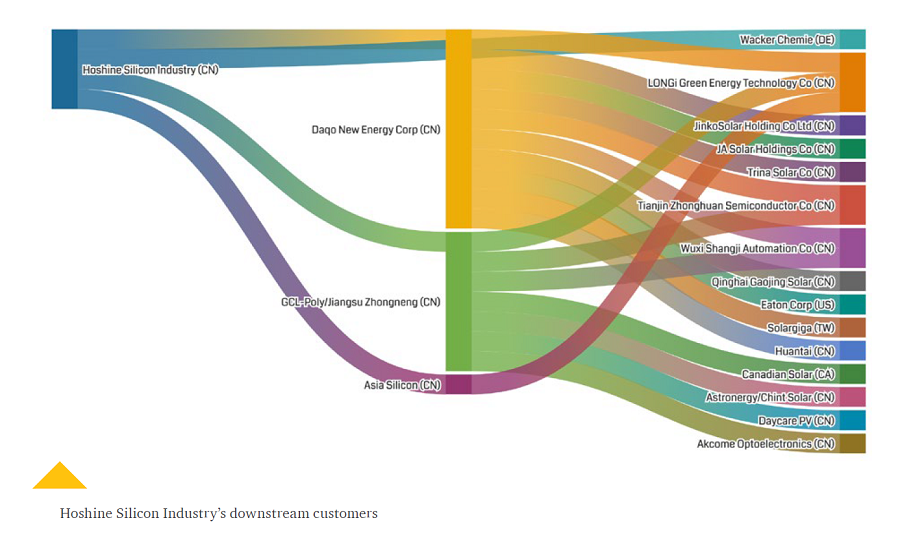

A new report from Sheffield Hallam University Helena Kennedy Centre, “In Broad Daylight” published in May 2021, traces major solar supply chains from raw materials to panel production, indicating significant forced labor exposure that has tainted the entire sector. A total of 90 Chinese and international companies are affected by Uyghur forced labor through their supply chains. For example, the Xinjiang Hoshine Silicon Industry Co., Ltd, the world’s largest metallurgical-grade silicon producer, has for years engaged in state-sponsored labor transfer programs to procure raw materials. Hoshine has also heavily benefited from subsidies and support from the Xinjiang Product Construction Corps (XPCC), a paramilitary organization subordinate to the Chinese Communist Party, and subject of a WRO issued in December 2020 by the US Customs and Border Protection due to their use of forced labor. The report traces the large number of companies that Hoshine supplies, as shown in the chart below.

With pending legislation in the form of the proposed Uyghur Forced Labor Prevention Act, companies will be prohibited from importing any component that comes from Xinjiang, including polysilicon, unless companies can prove there is no forced labor being used.

But forced labor isn’t the only risk of the solar sector in Xinjiang. The report also uncovers the damaging environmental impact of solar panel production in Xinjiang. In order to create polysilicon for solar panels, raw materials must be purified at extremely high temperatures. Unfortunately, factories in China burn an enormous amount of coal, the dirtiest of fossil fuels, for the electricity needed to maintain that heat. Heavy subsidies from the Chinese government in the Xinjiang coal industry have given China a near-monopoly on the market at all stages of the solar panel manufacturing process, effectively undercutting the solar panel production industries in Korea, the United States, and the European Union. As more investors flock to ESG investing and specifically seek out green, renewable energy opportunities to help rein in climate change, they are likely unaware that they may be inadvertently contributing to dangerous carbon emissions.

Under the UN Guiding Principles for Business and Human Rights, investors may be directly linked to these human rights violations and environmental harms through their investments in companies sourcing from Xinjiang. Investors are advised to undertake human rights due diligence and use their leverage, alone and in collaboration with other investors and stakeholders, to cease, prevent, or mitigate such harms. If however, they are unsuccessful in moving companies to address these risks, they must reconsider the wisdom of maintaining the investment relationship. As a start, investors can use Appendix A (page 48) in the Sheffield Hallam University report, which provides a list of the 90 companies with details of forced labor exposures, to review their investment portfolio.

The Investor Alliance for Human Rights has published an Investor Guidance on the Human Rights Crisis in the Xinjiang Uyghur Autonomous Region that provides practical guidance to investors on how to engage with their portfolio companies and other stakeholders to address these state-sanctioned human rights violations. The Investor Alliance is also coordinating a collective and coordinated investor initiative to engage with portfolio companies linked to or implicated through their value chains, the egregious human rights crisis in Xinjiang. For more details, please refer to our website or contact Anita Dorett at adorett@iccr.org.