Investors with over US$4.5 trillion in assets call out leading companies over human rights performance

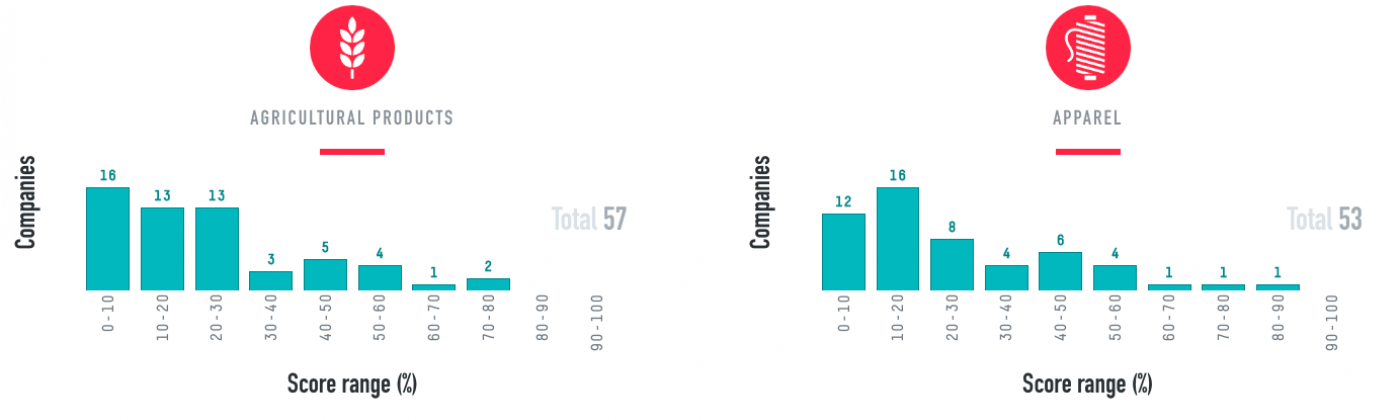

New York / London, 23rd March 2020 – A group of 176 international investors representing over $4.5 trillion in assets under management have joined forces to call out the human rights performance of some of the world’s most well-known companies. The 95 worst performing companies on human rights due diligence in the latest Corporate Human Rights Benchmark (CHRB), which include Canon, Carlsberg, Starbucks, Gazprom, Ralph Lauren and Costco Wholesale have been urged to take decisive action before June 2020 when the next assessment begins.

The letter, coordinated by the Investor Alliance for Human Rights, targets every company that scored 0 on human rights due diligence in its 2019 ranking. These are checks that reasonable and prudent companies carry out to identify, prevent, mitigate, and account for how they address the most severe risks to people in connection with their business.

“Human rights due diligence is at the heart of any good approach to managing human rights risks, yet the 2019 Corporate Human Rights Benchmark identified 95 companies that do not do enough in this area. We are delighted that this diverse group of international investors has come together to call for immediate action from these companies,” said Camille Le Pors, Corporate Human Rights Benchmark Lead at World Benchmarking Alliance.

CHRB, which is part of the World Benchmarking Alliance, measures how companies perform across 100 indicators based on the UN Guiding Principles on Human Rights. It uses publicly available information on issues such as forced labour, protecting human rights activists and the living wage to give companies a maximum possible score of up to 100%.

“It is alarming to see so many companies falling short. Like all business actors, investors have a responsibility to respect human rights under the UN Guiding Principles on Business and Human Rights, as well as emerging regulatory developments in different countries. This entails knowing and showing that our investments do not pose risks to people, yet our ability to do so hinges on robust due diligence among beneficiary companies and corporate transparency around such efforts. This letter is a call for prompt and concrete action,” said Magdalena Kettis, Active Ownership director, Nordea Asset Management.

As well as being something that responsible companies should be doing as a matter of course, mitigating human rights risks makes clear business sense as it reduces exposure to other risks such as operational delays, reputational harm, financial loss, and legal liabilities.

“Human rights issues present material risks to many companies, as well as a financial risk to their investors. The CHRB contains useful performance data and, whilst it was reassuring to see Adidas, Unilever and Inditex towards the top of the table, it was highly alarming that some of the largest brands in the world are governing human rights so poorly. We are now calling for prompt and concrete action from the laggards, including Arcelor Mittal, Carlsberg, Gazprom, Hon Hai, Macy’s, Prada and Starbucks. For our part, we will not hesitate to withdraw our support of these company boards at their AGMs if they do not resolve this critical situation as a matter of priority,” said Steve Waygood, Chief Responsible Investment Officer at Aviva Investors and Chair of the CHRB Board.

The investor letter brings together a coalition of asset managers, public pension funds, and faith-based investors from 15 countries across 3 regions. It demonstrates that socially responsible investors around the globe are increasingly coalescing around the need to ensure that companies integrate respect for human rights at the heart of their business.

“At APG, we use the CHRB data in our investment analysis. We also bring it to the table with us when we engage companies on their human rights performance. It helps us be explicit about our expectations. The large support for this statement shows that more and more investors want companies to take their responsibility seriously when it comes to impacting individuals, communities and the environment," said Anna Pot, Head of Responsible Investment Americas at APG Asset Management.

To learn more about this effort, please contact Anita Dorett at adorett@iccr.org.